As the title of this blog post implies, our journey for life insurance all started with a motorcycle…

As the title of this blog post implies, our journey for life insurance all started with a motorcycle…

I imagine you might be thinking this was the classic scenario of a husband who desperately wanted a motorcycle and a wife who quickly shot his crazy idea down with a quip like “if you buy a motorcycle then we will for sure be getting life insurance!” But that would be completely incorrect.

In fact, it was I who thought that the PERFECT 30th birthday gift for my husband would be a shiny new motorcycle. To be perfectly honest, I was on the verge of a mental breakdown (literally) but the intent was there ha-ha! The story goes that I wanted to give my husband a really amazing 30th birthday present that he would never expect and absolutely LOVE. There was 100% heart behind this decision, but logic isn’t always my strong suit.

When I brought this surprise gift up to my father-in-law, he was at first positive about the idea. However, after he had time to think it over, he advised me that buying a motorcycle wasn’t just buying a motorcycle. It was paying for the upkeep, the gear, the insurance, etc., etc., etc. The more he talked, the more I realized that this lofty goal was perhaps just that, a bit too lofty for our current circumstances. I highly respect my father-in-law and his opinions, and during this conversation, he also brought up life insurance. Funnily enough, my mom had brought up life insurance not long before. To me, it seemed like this was something my husband and I should really think about.

Long story short, after almost signing the dotted line on a motorcycle, I decided that I should talk it over with my husband. While he thought that I was the sweetest human ever for even thinking about buying him a motorcycle, he agreed it wasn’t the right time, and that we should look into more important things on our to-buy list, such as life insurance.

Fast forward a couple of months, I was approached by PolicyMe, a life insurance provider, to shed some light on the importance of life insurance for families. This partnership felt serendipitous because if you’re like me, you feel overwhelmed by the prospect of choosing a life insurance provider. Prior to working with PolicyMe, I was a novice when it came to life insurance and struggled to choose which type would work best for me and my family. It also felt difficult to bring myself to invest in life insurance because it isn’t a tangible item that I can reap immediate benefits from.

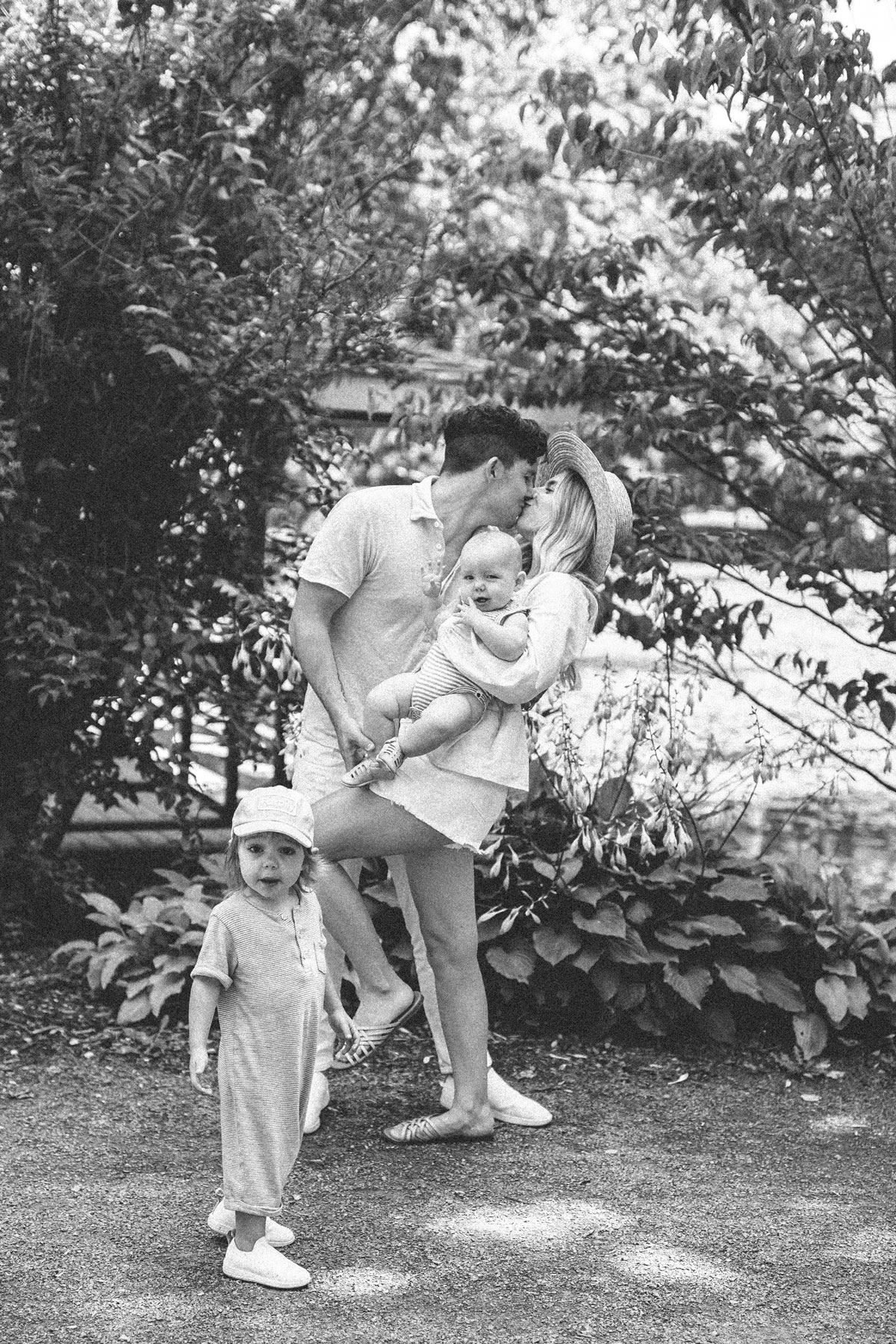

However, all of that aside, having a child means protecting them at all costs. Whether that be holding their hand when they’re crossing the street, catching them before they fall, or helping them cope with big feelings, we want to protect our children from all of life’s unknowns. One of the things we often don’t want to think about, but that we should, is protecting them financially…in case something happens to their protectors.

With that said, I’m excited to share about PolicyMe plus as a bit about the different types of life insurance, and why term life insurance might be the best option for those of us with young children. Keep reading to learn more about life insurance! Financially protecting loved ones through life insurance doesn’t have to be as daunting or expensive as it seems. The reality is that many parents have costly life insurance products, rather than the more affordable ‘term life insurance’. This may be why 50% of parents who don’t have life insurance say they haven’t bought it because it is too expensive. Too many parents are purchasing costly and often unnecessary life insurance policies rather than more affordable term life insurance (more details below).

Financially protecting loved ones through life insurance doesn’t have to be as daunting or expensive as it seems. The reality is that many parents have costly life insurance products, rather than the more affordable ‘term life insurance’. This may be why 50% of parents who don’t have life insurance say they haven’t bought it because it is too expensive. Too many parents are purchasing costly and often unnecessary life insurance policies rather than more affordable term life insurance (more details below).

PolicyMe is an online life insurance company that allows Canadian parents to buy term life insurance in minutes, 100% online, at the most affordable price. PolicyMe has simplified all the unnecessary bells and whistles in the traditional life insurance process, resulting in a fully-underwritten term life policy that’s fast, easy and affordable. They understand that today’s parents are busier than ever, and buying life insurance is only one to-do on a long list of priorities.

PolicyMe is an online life insurance company that allows Canadian parents to buy term life insurance in minutes, 100% online, at the most affordable price. PolicyMe has simplified all the unnecessary bells and whistles in the traditional life insurance process, resulting in a fully-underwritten term life policy that’s fast, easy and affordable. They understand that today’s parents are busier than ever, and buying life insurance is only one to-do on a long list of priorities. Their mission is to make this traditional and entrenched process easier, more transparent, and more affordable for anyone who needs it. The application for PolicyMe’s term life insurance product takes about 15 minutes to complete and when you apply with PolicyMe, most applicants receive a decision instantly (instead of in weeks). Additionally, most don’t require a medical exam.

Their mission is to make this traditional and entrenched process easier, more transparent, and more affordable for anyone who needs it. The application for PolicyMe’s term life insurance product takes about 15 minutes to complete and when you apply with PolicyMe, most applicants receive a decision instantly (instead of in weeks). Additionally, most don’t require a medical exam. 77% of Canadian parents do already have life insurance, however, PolicyMe talked to over 1,500 Canadian parents about their life insurance and found that many of them were making four common mistakes that leave their families unprotected. If you already have life insurance, make sure that you aren’t making these 4 common mistakes:

77% of Canadian parents do already have life insurance, however, PolicyMe talked to over 1,500 Canadian parents about their life insurance and found that many of them were making four common mistakes that leave their families unprotected. If you already have life insurance, make sure that you aren’t making these 4 common mistakes:

Life insurance solely through work benefits: 70% of Canadian parents with children under 18 have life insurance through their workplace. Of those 70%, 44% rely on it solely, which is typically insufficient to protect their family. Life insurance is a great employee benefit to have, however, it is often not sufficient on its own and should be viewed as complementary to a more robust term life insurance policy.

Life insurance solely through work benefits: 70% of Canadian parents with children under 18 have life insurance through their workplace. Of those 70%, 44% rely on it solely, which is typically insufficient to protect their family. Life insurance is a great employee benefit to have, however, it is often not sufficient on its own and should be viewed as complementary to a more robust term life insurance policy.

Mortgage Life Insurance: A quarter of Canadian parents (25%) with children under the age of 18 have mortgage life insurance. This product is protection for banks and creditors, not for parents.

Mortgage Life Insurance: A quarter of Canadian parents (25%) with children under the age of 18 have mortgage life insurance. This product is protection for banks and creditors, not for parents.

Permanent Life Insurance (including “universal” or “whole life”): 22% of parents with children under 18 have bought the very expensive, complicated and often unnecessary permanent life insurance product. Permanent life insurance is 5-15x the cost of term life insurance and unnecessary if you don’t expect to have dependents or debt in the future.

Permanent Life Insurance (including “universal” or “whole life”): 22% of parents with children under 18 have bought the very expensive, complicated and often unnecessary permanent life insurance product. Permanent life insurance is 5-15x the cost of term life insurance and unnecessary if you don’t expect to have dependents or debt in the future.

Life Insurance for Children: 23% of parents purchased their children their own life insurance policy, which is yet another unnecessary product. Often, parents buy these policies as a way to put money aside for their children, but a savings account or investing is a better way to save for a child’s financial future.

You can read the full survey results to learn more about common mistakes Canadian parents are making with life insurance–and what to do instead! Read the full survey results here.

If you’ve made it this far, then you’ve probably learned that there is A LOT to know and understand about life insurance. I hope that I was able to shed some light on this oftentimes daunting topic and to help you feel better prepared in making the correct life insurance decision for you and your family. I know that personally, after learning all of this information, I feel SO much better about making an informed decision moving forward with a life insurance provider, and I hope you do as well! We’re all in this together! Check out PolicyMe.com to learn more and get your instant, personalized quote.

If you’ve made it this far, then you’ve probably learned that there is A LOT to know and understand about life insurance. I hope that I was able to shed some light on this oftentimes daunting topic and to help you feel better prepared in making the correct life insurance decision for you and your family. I know that personally, after learning all of this information, I feel SO much better about making an informed decision moving forward with a life insurance provider, and I hope you do as well! We’re all in this together! Check out PolicyMe.com to learn more and get your instant, personalized quote. This post was proudly brought to you by PolicyMe

This post was proudly brought to you by PolicyMe

Photography by Raelene Giffin